March 9, 2024 | Vol. 20 |

With a record-breaking warm winter and confidence in lower rates ahead, we saw early activity from both sellers and buyers this February. Population growth and a resilient regional economy continued to support the overall demand for housing. Higher borrowing costs kept home sales below the record year 2021 but overall higher than the previous year. The Bank of Canada announced on March 6th a rate hold once again, and we will cover what that means for our economy in this edition. Whether you're a tenant, a landlord, or a homeowner, we aim to provide insightful content for all. Additionally, we invite you to join us next Wednesday via IG or Zoom (reply to request Zoom link) for more details on market trends and to answer your questions. |

*Join Us Wednesday, March 13 at 7 pm IG LIVE & Zoom Market Update and Q&A* ** Follow @MoRealtyTeam for daily market updates** |

Home Tip Checklist |

With warm weather comes snow melting, and this is the perfect time to check for the following; A/C Cover: Reminder to remove your A/C cover and clean any debris on it. If the unit is dusty spray it with hose water to keep the fins on the side clean to work optimally. Inspect Garden: Check for any winter damage to plants, structures, or pathways. Trim back any damaged or dead branches, and start pruning those plants for a healthy garden. Gutters: Ensure all the gutters are free of debris, intact and water is coming down the spout and away from the house (ideally 10ft away). |

Family Friendly Event |

|

Timeless Toronto: A Visual Journey Through the 6ix Art Exhibition - FREEPresented by: Celebrate Toronto Engage in an exploration of Toronto’s dynamic urban narrative and the vibrancy of its cultural tapestry through artworks that encapsulate the city’s evolving identity. When: Every Saturday, February 21, 2024 - March 27, 2024 Event Time(s): 10:00 am - 1:00 pm Reception: February 22 at 6:00 p.m. The gallery is closed on Sundays and all statutory holidays. Where: Assembly Hall - 1 Colonel Samuel Smith Park Dr, Etobicoke, ON M8V 4B6, Canada |

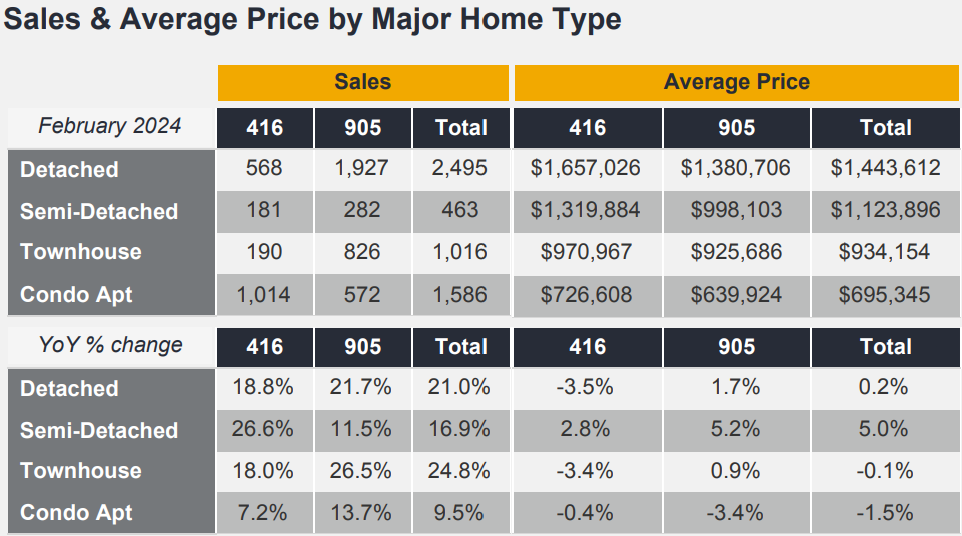

February Market Glance | ||||||||

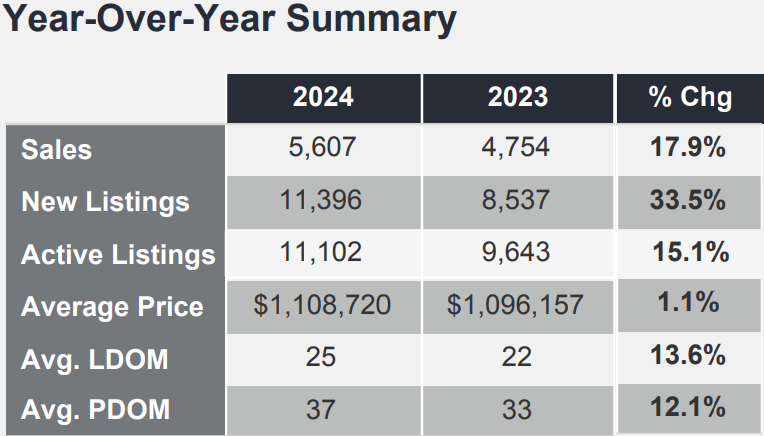

Charts Explained In February 2024, there were 5,607 home sales in the Greater Toronto Area (GTA), marking a 17.9 percent increase compared to February 2023. Even after factoring in the leap-year effect, sales still showed a significant rise of 12.3 percent year-over-year. New listings saw an even greater annual increase than sales, indicating a rise in options for prospective buyers. However, on a seasonally adjusted month-over-month basis, February sales dipped slightly following two consecutive monthly increases, while new listings remained unchanged. It's important to note that monthly figures can exhibit volatility, especially as the market approaches a transitional phase.

Home selling prices closely mirrored those of February 2023. The Home Price Index (HPI) Composite benchmark showed a slight increase of 0.4 percent. Meanwhile, the average selling price, totalling $1,108,720, saw a modest uptick of 1.1 percent. On a seasonally adjusted monthly basis, both the HPI Composite and the average selling price showed marginal increases. Rental market is starting to cool a bit, this is in part due to seasonal slow down, and also immigration policy which recently reduced the number of immigrants coming to Canada. The policy was especially aggressive on international students and private colleges, making it tougher to come into the country. This will slow demand in the rental market but may not be enough to bring the housing shortage to a balance. We anticipate that this slowdown is temporary and expect the spring market to help pick things up in the rental market. | ||||||||

*Join us Wednesday, March 13th at 7 pm IG LIVE & Zoom Market Update and Q&A* ** Follow @MoRealtyTeam for daily market updates** | ||||||||

Market Rates | ||||||||

Mortgage Rates as of March 8, 2024:

| ||||||||

Economic Update

| ||||||||

BUYER STRATEGY WITH CURRENT HIGH RATES:

Consider houses with separate entrance basements (can rent 1-bedroom basements for over $1900+/m) | ||||||||